In California, there’s a crucial consumer protection regulation known as the 10-day rule that every car buyer should understand. This rule serves as a safeguard against auto fraud such as predatory lending practices and ensures transparency in the car buying process. Let’s break down what this means for you and how it protects your rights when purchasing a vehicle.

What You Need to Know About the 10-Day Financing Rule

The 10-day rule is a cornerstone of consumer protection in California’s auto industry. When you purchase a car from a dealer in California, they have exactly 10 days to secure financing for your auto loan. This rule applies whether you’re buying a new car or a used car, and it’s designed to protect consumers from deceptive financing practices.

The regulation prevents dealers from using high-pressure tactics or changing terms after you’ve already taken possession of the vehicle. Understanding this rule is crucial because it gives you specific rights and protections during the financing process.

How Your Down Payment and Trade-In Vehicle Are Protected

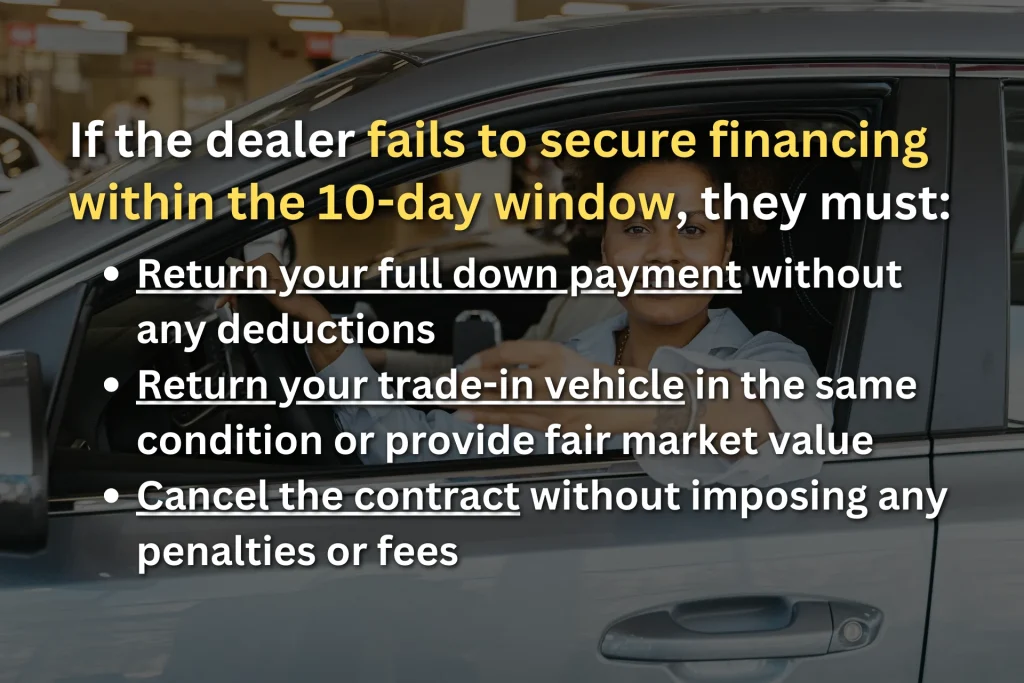

One of the most significant aspects of the car buying process involves your down payment and trade-in vehicle. These elements are crucial parts of your purchase contract and come with specific protections under the law. If the dealer fails to secure financing within the 10-day window, they must:

- Return your full down payment without any deductions

- Return your trade-in vehicle in the same condition or provide fair market value

- Cancel the contract without imposing any penalties or fees

Many buyers don’t realize that their trade-in vehicle rights are protected under this rule. The dealer must either return your exact vehicle or provide fair market compensation if they’ve already sold it. This protection ensures that you won’t lose value on your trade-in if the financing falls through.

Comparing Your Financing Agreement Options

The world of auto loans can seem overwhelming, but understanding your financing options is crucial for making an informed decision. When seeking financing, you have several paths to consider:

- Traditional banks offering competitive rates

- Credit unions with member-focused benefits

- Finance companies specializing in auto loans

- Dealer financing with potential manufacturer incentives

Many buyers find that credit unions offer more favorable interest rates than traditional financial institutions. It’s worth exploring multiple financing options before signing any binding contract, as rates and terms can vary significantly between lenders.

A good financial advisor can help you understand which financing options best suit your situation, taking into account factors like your credit score, down payment amount, and desired monthly payment.

Understanding the Role of Banks and Credit Unions in Auto Financing

Financial institutions like banks and credit unions play a crucial role in the car financing process. These lenders often provide more competitive interest rates than dealer financing for several important reasons:

- They have established, transparent lending criteria

- They offer pre-approval options that strengthen your negotiating position

- They typically provide more straightforward terms without hidden fees

- They may have special programs for existing customers or members

Before visiting the dealership, consider getting pre-approved through your bank or credit union. This pre-approval gives you a clear understanding of your budget and helps you avoid being pressured into less favorable dealer financing terms.

Protecting Your Rights: What Happens When Dealer Financing Falls Through

One of the most critical aspects of the 10-day rule comes into play when a dealer can’t secure financing as promised. In these situations, you have specific rights that protect your interests. If the dealer can’t obtain financing within 10 days, two important scenarios can unfold:

- The dealer becomes the lender and must honor the original financing terms, including:

- The same interest rate

- The same monthly payment structure

- All originally agreed-upon terms

- You can choose to return the car and cancel the purchase contract, which entitles you to:

- A full refund of your down payment

- Return of your trade-in or its value

- Cancellation without penalties

Understanding these options is crucial for protecting your rights as a buyer. Don’t let dealers pressure you into accepting less favorable terms just because their preferred financing fell through.

Understanding How Finance Companies Impact Your Car Loan Options

When shopping for auto loans, you’ll likely encounter various finance companies, each offering different terms and conditions. These specialized lending institutions play a distinct role in the car financing landscape, often providing options that differ from traditional banks or credit unions. Consider these critical factors when evaluating finance company offers:

- Interest rate variations based on:

- Your credit score

- Loan term length

- Vehicle age and type

- Down payment amount

- Loan term options that affect:

- Monthly payment calculations

- Total cost of ownership

- Early payment penalties

- Additional fees and charges

Some financing companies specialize in specific types of auto loans or credit situations, making them valuable options for buyers with unique circumstances. Understanding how these companies operate can help you make an informed decision about your car loan.

How Your Credit Score Shapes Your Auto Financing Journey

Your credit score plays a pivotal role in determining your financing options and terms. This three-digit number impacts everything from interest rates to loan approval probability. Here’s what you need to know about credit scores and car financing:

- Higher scores typically result in:

- Better interest rates

- More flexible loan terms

- Lower down payment requirements

- Access to special financing programs

Many lenders specialize in different credit ranges, and working with a financial advisor can help you improve your credit before applying for auto loans. Remember that multiple loan applications within a short period usually count as one inquiry, allowing you to shop around without damaging your credit score.

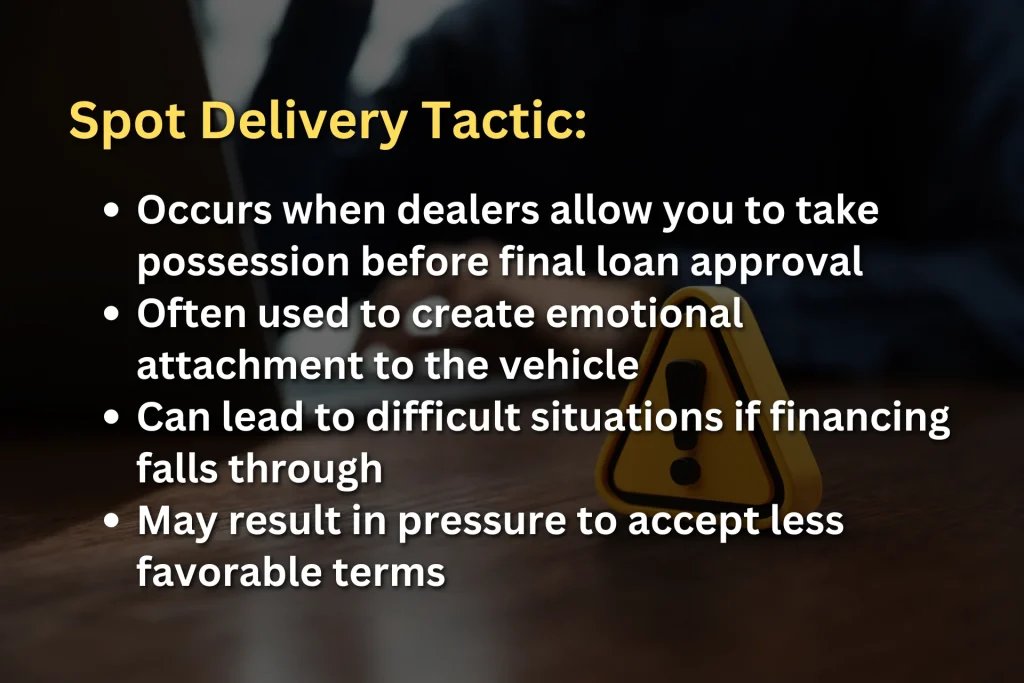

Spot Delivery and Yo-Yo Financing: Protecting Yourself from Predatory Practices

Two particularly concerning dealer practices have emerged in the car financing industry: spot delivery and yo-yo financing. Understanding these tactics is crucial for protecting yourself during the car buying process:

Spot Delivery:

- Occurs when dealers allow you to take possession before final loan approval

- Often used to create emotional attachment to the vehicle

- Can lead to difficult situations if financing falls through

- May result in pressure to accept less favorable terms

Yo-Yo Financing:

- Happens when dealers attempt to change financing terms after the sale

- Often targets buyers weeks after taking possession

- Can put you at risk of falling victim to predatory lending

- May involve threats or intimidation tactics

Learning to recognize these practices helps you avoid becoming a target for unethical dealers. Always insist on final loan approval before taking possession of your new vehicle.

Your Rights Under California Auto Financing Law

California law provides robust protections for car buyers, particularly regarding financing agreements. When a dealer calls to say they can’t secure financing, you have specific rights that protect your interests:

Maintaining Original Terms:

- You can keep the car under the original contract terms

- The dealer must honor all aspects of the purchase agreement

- No additional fees can be added

- Interest rates must remain as originally agreed

Return Rights:

- You can return the car without penalty

- All down payments must be refunded

- Trade-in value must be honored

- No restocking fees can be charged

Contract Protection:

- Original purchase contract remains binding

- Dealers cannot force new terms

- All verbal promises must be honored

- Documentation requirements must be met

Don’t let dealers pressure you into accepting new paperwork or different terms – your rights are protected by law.

The Essential Elements of Your Purchase Contract

Your purchase contract serves as a binding legal document that protects both buyer and seller. Understanding each component ensures you’re fully informed about your rights and obligations:

Required Contract Elements:

- Complete purchase price breakdown

- Detailed financing terms

- Trade-in vehicle information

- Down payment amount and structure

- Monthly payment schedule

- Interest rate and loan term

- Additional fees and charges

Documentation Requirements:

- All agreements must be in writing

- Changes require mutual consent

- Copies must be provided promptly

- Signatures must be properly witnessed

Keep detailed records of all contracts and related documents, as they’re crucial for protecting your rights throughout the financing process.

Understanding the Loan Application Process: From Submission to Approval

The loan application process involves multiple steps and requires careful attention to detail. Here’s what you need to know about how dealers and lenders process your application:

Initial Application:

- Dealers submit your information to multiple lenders

- Credit reports are pulled and evaluated

- Income verification is conducted

- Employment history is reviewed

Approval Factors:

- Credit score implications

- Debt-to-income ratio

- Employment stability

- Down payment amount

- Vehicle selection

Timeline Considerations:

- The 10-day rule starts at application

- Multiple lenders may review simultaneously

- Approval decisions vary by lender

- Communication requirements exist

Understanding this process helps you navigate the approval timeline and protect your rights under the 10-day rule.

Legal Options and Consumer Protection: What to Do When Things Go Wrong

When problems arise with your car financing, having a clear action plan is essential. Understanding your legal options helps you respond effectively to dealer violations or financing issues:

Immediate Actions:

- Document all communications with the dealer

- Save emails and text messages

- Record dates and times of phone calls

- Keep notes from in-person conversations

- Maintain a timeline of events

- Preserve Documentation:

- Purchase contract copies

- Financing agreement details

- Trade-in vehicle paperwork

- Down payment receipts

- All related correspondence

- Legal Resources:

- Contact consumer protection attorneys

- File complaints with regulatory agencies

- Understand cancellation rights

- Know statutory deadlines

Don’t wait to take action if you suspect your rights have been violated. Early intervention often leads to better outcomes.

Common Dealer Tactics: Recognizing and Responding to Pressure Techniques

Car dealers sometimes employ various tactics to pressure buyers into less favorable terms. Being able to recognize these strategies helps you maintain control of your car-buying process:

High-Pressure Sales Techniques:

- Urgency creation (“This deal ends today”)

- Limited time offers

- Hidden fees and charges

- Emotional manipulation

- Package deal pressure

Red Flags to Watch For:

- Requests to sign new contract terms

- Claims of denied loan applications

- Unexpected purchase price changes

- Demands for additional down payment

- Threats or intimidation tactics

Remember that legitimate dealers operate transparently and don’t need to use pressure tactics to close deals.

Essential Steps for Protecting Yourself Throughout the Car Buying Process

A successful car purchase requires careful attention to detail and a thorough understanding of the process. Follow these steps to ensure your interests are protected:

Before Shopping:

- Research vehicle prices and values

- Get pre-approved through banks or credit unions

- Understand market interest rates

- Review your credit report

- Set a realistic budget

During Purchase:

- Review all paperwork carefully

- Never sign incomplete documents

- Keep copies of everything

- Get all promises in writing

- Understand all terms and conditions

After Purchase:

- Monitor your loan approval status

- Keep communication records

- Watch for unexpected changes

- Know your rights under the 10-day rule

- Stay informed about payment processing

Understanding Lender Requirements: Banks, Credit Unions, and Finance Companies

Different types of lenders have varying requirements and approaches to auto financing. Understanding these differences helps you choose the best option for your situation:

Traditional Banks:

- Often require strong credit history

- May offer better rates to existing customers

- Usually have standardized approval criteria

- Provide pre-approval options

- Offer consistent lending terms

Credit Unions:

- Member-focused approach

- Often offer lower interest rates

- More flexible approval criteria

- Personalized service

- Special member programs

Finance Companies:

- Specialize in auto loans

- May work with challenging credit

- Often partner with specific dealers

- Might offer unique programs

- Could have higher interest rates

Maximizing Value: Expert Tips for Trade-In Vehicle Transactions

Your trade-in vehicle represents a significant part of your car-buying transaction. Understanding how to maximize its value helps you get the best possible deal:

Preparation Steps:

- Get multiple appraisals

- Research fair market value

- Document vehicle condition

- Gather maintenance records

- Understand market trends

Protection Measures:

- Get trade-in value in writing

- Understand tax implications

- Know your vehicle’s worth

- Document vehicle condition

- Keep all related paperwork

Rights and Safeguards:

- Trade-in protection under the 10-day rule

- Value preservation requirements

- Return conditions

- Documentation needs

- Legal protections

The Critical Role of Documentation in Protecting Your Rights

Proper documentation serves as your primary protection throughout the car-buying process. Understanding what to keep and how to organize it is essential:

Essential Documents:

- Purchase contracts

- Financing agreements

- Trade-in documentation

- Down payment receipts

- Communication records

Organization Tips:

- Create digital copies

- Maintain chronological order

- Use clear labeling systems

- Store documents securely

- Keep everything accessible

Legal Considerations:

- Statutory requirements

- Proof of transactions

- Consumer protection evidence

- Dispute resolution support

- Compliance documentation

Understanding Finance Terms and Calculations: Making Informed Decisions

Making sense of financing terms and calculations helps you evaluate offers and make better decisions:

Key Concepts:

- Annual Percentage Rate (APR)

- Principal and interest calculations

- Term length implications

- Total cost of ownership

- Payment structure options

Important Calculations:

- Monthly payment formulas

- Total interest paid

- Early payoff benefits

- Fee structures

- Cost comparisons

Getting Professional Help: When and How to Seek Legal Assistance

At Consumer Action Law Group, we help car buyers who are dealing with dealer problems. If you’re facing issues with your car purchase, you don’t have to handle it alone.

When to Call Us:

- Dealer won’t honor the original contract

- Problems with your financing agreement

- Issues getting your trade-in back

- Missing or incorrect paperwork

- Dealer pressure tactics or harassment

We Can Help You:

- Stand up to aggressive dealers

- Get your money back

- Protect your rights

- Fix financing problems

- Deal with contract violations

Our dealer fraud attorneys at Consumer Action Law Group have helped many car buyers just like you. We know how to handle dealer problems and protect your rights under California law. Whether you’re dealing with financing issues, contract problems, or other concerns, we’re here to fight for you.

The best part? Your initial consultation is completely free. We’ll review your case and explain your options in clear, simple terms. You have nothing to lose by calling us to understand your rights.

Contact Consumer Action Law Group today for your free consultation about your car financing situation. Let us help you resolve any issues you’re experiencing with your vehicle purchase or financing agreement.

Find Out If You Have A Case In 5 Minutes