In today’s bustling marketplace, consumers face an overwhelming array of products and services. Unfortunately, this abundance also brings the risk of fraud, scams, and deceptive practices. Nowhere is this more prevalent than in the automotive industry, where complex transactions and high-stakes purchases can leave buyers vulnerable to unethical dealers. This comprehensive guide will help you understand your rights as a consumer, recognize common auto fraud tactics, and take action if you’ve been victimized.

The Rise of Auto Fraud

Auto fraud is a growing concern in the United States. Recent statistics show that auto fraud losses are expected to reach $6 billion in 2024, a significant increase from $2 billion in 2015. As schemes become more sophisticated and elaborate, many consumers fall victim without even realizing it until long after the purchase.

Common Types of Auto Fraud

- Odometer rollbacks

- Misrepresenting a vehicle’s accident history

- Selling salvage vehicles without proper disclosure

- Lying about a vehicle’s features or condition

- Padding loan applications with false information

- Selling used cars as new

- Bait-and-switch tactics

- Hiding or misrepresenting finance terms

- Failing to disclose known defects

Consumer Protection Laws: Your Shield Against Fraud

Fortunately, both federal and state laws exist to protect consumers from fraudulent practices. These consumer protection laws hold sellers accountable and prohibit them from profiting through deception or fraud.

What Are Consumer Rights?

Consumer rights are legal protections that allow individuals to fight back against businesses that engage in deceptive or fraudulent practices. These laws are enforced by government agencies and give consumers the right to sue businesses that violate these protections.

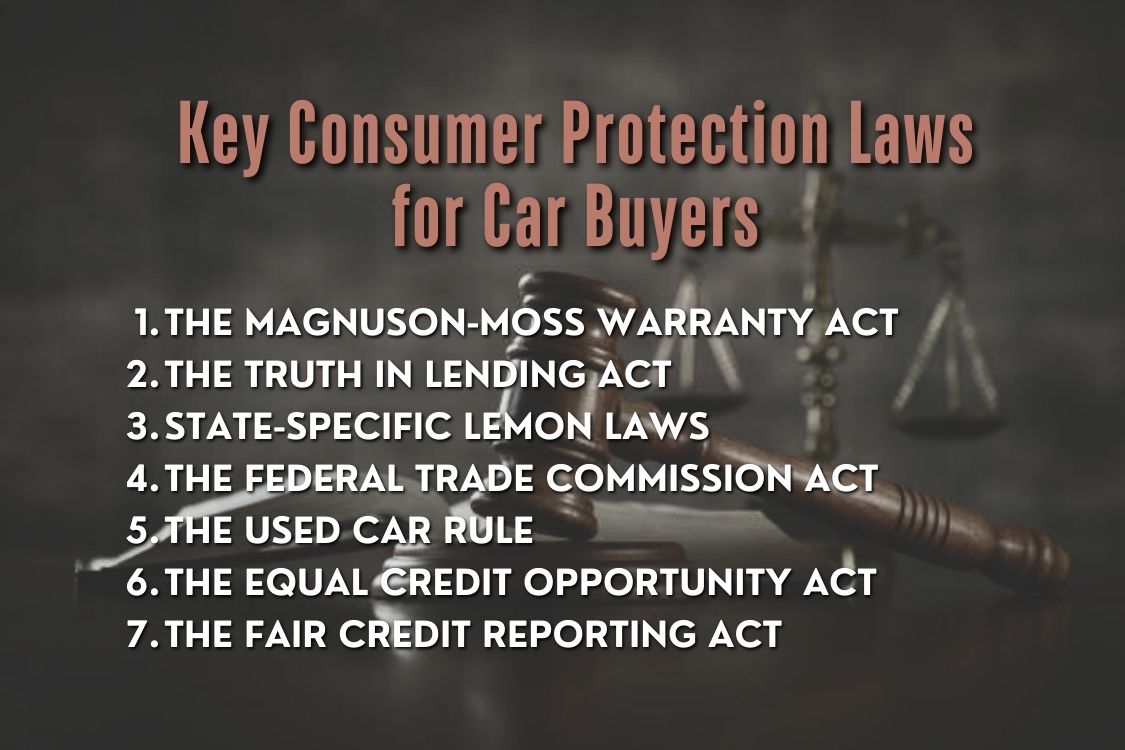

Key Consumer Protection Laws for Car Buyers

- The Magnuson-Moss Warranty Act: Governs warranties on consumer products, including vehicles

- The Truth in Lending Act: Requires clear disclosure of loan terms and costs

- State-specific lemon laws: Protect buyers of defective vehicles

- The Federal Trade Commission Act: Prohibits unfair or deceptive practices in commerce

- The Used Car Rule: Requires dealers to provide buyers with a Buyers Guide for used vehicles

- The Equal Credit Opportunity Act: Prohibits discrimination in lending

- The Fair Credit Reporting Act: Regulates the collection and use of consumer credit information

How to Spot a Fraudulent Car Dealer

Buying a car should be an exciting experience, not a stressful one. But it’s important to be aware that not all dealerships have your best interests at heart. Some might try to pressure you into a quick decision, hide important details about the car’s history, or sneak in extra fees.

To avoid falling victim to these shady tactics, keep an eye out for these red flags. If a dealer seems pushy, evasive, or too good to be true, trust your gut and walk away.

A reputable dealer will be transparent, answer all your questions honestly, and give you the time and space you need to make an informed decision.

When shopping for a vehicle, be on the lookout for these warning signs of potential fraud:

- Pressure to make a quick decision

- Reluctance to provide vehicle history reports

- Vague or evasive answers to specific questions

- Unexplained fees or charges

- Promises of deals that seem too good to be true

- Unwillingness to let you take the car for an independent inspection

- Pushing extended warranties or unnecessary add-ons

- Changing terms or prices after verbal agreements

Your Rights When Buying a Car

Empower yourself as a car buyer by understanding the rights that protect you. You have the right to a transparent transaction, starting with a clear contract in your preferred language.

Don’t hesitate to request a vehicle history report for used cars and be aware of any cooling-off period that your state may offer. If the dealer engages in deceptive practices or breaches the contract, you have the right to legal recourse.

Remember, the power to negotiate price and terms is in your hands, including the option to decline dealer-arranged financing. Additionally, you can request a detailed breakdown of all charges before finalizing the purchase. By being informed and assertive, you can ensure a fair and satisfactory car buying experience.

Here are some key rights you should be aware of:

- The right to a clear, single-document contract

- The right to a translated contract in your preferred language

- The right to a vehicle history report for used cars

- The right to a cooling-off period in some states

- The right to sue for breach of contract or fraud

- The right to negotiate the price and terms of the sale

- The right to refuse dealer-arranged financing

- The right to a written itemization of all charges

What to Do If You’ve Been Scammed

If you suspect you’ve been taken advantage of by a car dealer, don’t despair. Start by gathering all your paperwork related to the purchase, including the contract, any emails or text messages, and receipts.

Then, reach out to the dealership directly and see if they’re willing to rectify the situation. If they’re unresponsive or unhelpful, escalate the issue by filing a complaint with your state’s consumer protection agency.

Consider consulting with an attorney specializing in auto fraud to understand your legal options. It’s also a good idea to report the incident to the Federal Trade Commission and the Better Business Bureau. Remember, documentation is key, so keep a record of all your communication attempts with the dealer.

By taking these steps, you’ll be protecting yourself and potentially helping others avoid the same scam.

If you believe you’ve been the victim of auto fraud, take these steps:

- Document everything related to the purchase

- Contact the dealership to try resolving the issue

- File a complaint with your state’s consumer protection agency

- Consult with an experienced auto fraud attorney

- Report the fraud to the Federal Trade Commission

- Consider filing a complaint with the Better Business Bureau

- Document all communication attempts with the dealer

The Power of Legal Representation

While you can attempt to resolve issues with a dealership on your own, having an experienced auto fraud attorney on your side can significantly improve your chances of a favorable outcome. These legal professionals understand the intricacies of consumer protection laws and can navigate the complex process of holding fraudulent dealers accountable.

Common Auto Fraud Scenarios and How to Address Them

Scenario 1: The Bait and Switch

You see an advertisement for a car at an attractive price, but when you arrive at the dealership, they claim that car is no longer available and try to sell you a more expensive model.

Solution: If you can prove the original advertisement, you may have grounds for a lawsuit. Always save copies of ads and get promises in writing. Some states have specific laws against bait-and-switch tactics in car sales.

Scenario 2: Undisclosed Damage

You purchase a used car that the dealer claims is in excellent condition, only to discover later that it has significant frame damage from a previous accident.

Solution: Dealers are required to disclose known material defects. If you can prove they knew about the damage, you may be able to return the car and get your money back. In some cases, you might also be entitled to additional damages.

Scenario 3: Loan Application Fraud

The dealer inflates your income on a loan application to get you approved for a car you can’t afford.

Solution: This is a serious form of fraud that can have long-lasting consequences. Gather all documentation related to your loan and consult with an auto fraud attorney immediately. You may be able to have the loan contract voided and seek damages from the dealer.

Scenario 4: Yo-Yo Financing

You drive off the lot thinking your financing is approved, only to be called back days or weeks later and told you need to sign a new contract with worse terms.

Solution: This practice, known as yo-yo financing, is illegal in many states. If this happens to you, consult with an attorney immediately. You may have the right to keep the original terms or return the car without penalty.

How to Protect Yourself When Buying a Car

Do your homework before you hit the car lot. Know what kind of car you want and what it should cost. Don’t just take the dealer’s word for it – get everything in writing. Read all the paperwork carefully and don’t be afraid to ask questions.

Don’t feel pressured to make a decision right away, and bring a friend who knows about cars if you can. Always check the car’s history and have a mechanic look it over, especially if it’s used. Shop around for a loan before you go to the dealer so you know what kind of interest rate you can get.

Check out the dealer’s reputation online and avoid any that have a lot of complaints. And most importantly, trust your gut. If something seems fishy, walk away.

- Research the vehicle and its market value before shopping

- Get all promises and claims in writing

- Read all documents carefully before signing

- Don’t feel pressured to make a decision on the spot

- Consider bringing a knowledgeable friend or family member with you

- Always get a vehicle history report for used cars

- Have an independent mechanic inspect the vehicle before purchase

- Shop around for financing before visiting the dealership

- Be wary of dealerships with a history of complaints

- Trust your instincts – if something feels off, walk away

The Role of Consumer Attorneys

Consumer attorneys, also known as consumer protection attorneys, specialize in helping individuals who have been victims of fraud or unfair business practices. These legal professionals can assist with a wide range of issues, including:

- Auto dealer fraud

- Mortgage fraud

- Debt collection harassment

- False advertising

- Product liability cases

- Identity theft

- Unfair billing practices

- Credit reporting errors

When dealing with complex consumer protection issues, having an experienced attorney can make a significant difference in the outcome of your case. They can help you understand your rights, gather evidence, negotiate with the offending party, and represent you in court if necessary.

Taking Legal Action & What to Expect

If you’ve decided to take legal action against a shady car dealer, here’s what you can expect. First, you’ll talk to a lawyer who specializes in these cases.

They’ll look at your situation and let you know if you have a good case. If you do, they’ll start gathering evidence, like your contract, emails, and any other relevant documents. Your lawyer will usually try to work things out with the dealer first, but if that doesn’t work, they’ll file a lawsuit.

This means both sides will share information and there might be more chances to settle things outside of court. If no agreement is reached, the case will go to trial. Keep in mind that this process can take some time, and there might be appeals afterward.

The good news is that many lawyers who handle these types of cases only get paid if you win, so you don’t have to worry about upfront fees.

- Initial consultation with an attorney to evaluate your case

- Gathering of evidence and documentation

- Attempt to negotiate with the dealer for a resolution

- Filing a lawsuit if negotiations fail

- Discovery process, where both sides exchange information

- Potential settlement negotiations

- Trial, if a settlement isn’t reached

- Possible appeals process

Many consumer protection attorneys work on a contingency basis, meaning they only get paid if you win your case. This can make legal representation more accessible for many consumers.

The Importance of Consumer Education

Preventing auto fraud starts with informed consumers. Here are some ways to educate yourself:

- Attend consumer protection workshops in your community

- Stay updated on the latest scams through consumer protection websites

- Read reviews and complaints about dealerships before visiting

- Understand basic car mechanics to avoid technical deception

- Learn about financing options and interest rates before shopping

- Familiarize yourself with your state’s specific consumer protection laws

The Impact of Auto Fraud on Consumers and Society

Auto fraud doesn’t just affect individual consumers; it has broader societal impacts:

- Increased costs for honest consumers as dealerships try to recoup losses

- Reduced trust in the automotive industry

- Financial strain on victims, potentially leading to credit problems

- Unsafe vehicles on the road due to undisclosed defects

- Increased burden on the legal system to resolve disputes

By fighting against auto fraud, consumers not only protect themselves but also contribute to a fairer marketplace for everyone.

Empowering Consumers Through Knowledge and Action

Understanding your rights as a consumer and recognizing the signs of auto fraud are crucial steps in protecting yourself from unethical practices. By staying informed, asking the right questions, and knowing when to seek legal help, you can navigate the car-buying process with confidence.

Remember, if you believe you’ve been the victim of auto fraud, you’re not alone. Consumer protection laws exist to safeguard your rights, and experienced attorneys are available to help you fight back against fraudulent practices.

Have you been the victim of auto fraud? Don’t let unethical dealers take advantage of you. Contact an experienced auto fraud attorney today for a free consultation and take the first step toward justice.