Looking For The Best FCRA Attorney in Los Angeles?

Getting help from the best FCRA attorney in Los Angeles can be the difference between having a high and low interest. There are so many things that people do wrong that causes a drop in their credit score. Other times, it’s overlooking errors on their credit report that creates an inaccurate representation of their credit.

Whatever the reason, an experienced credit report attorney will be able to help clean up any errors that show up in your credit report. If the appropriate agencies fail to fix the errors, you may be entitled up to $1,000 per violation.

(818) 254-8413

What is the FCRA?

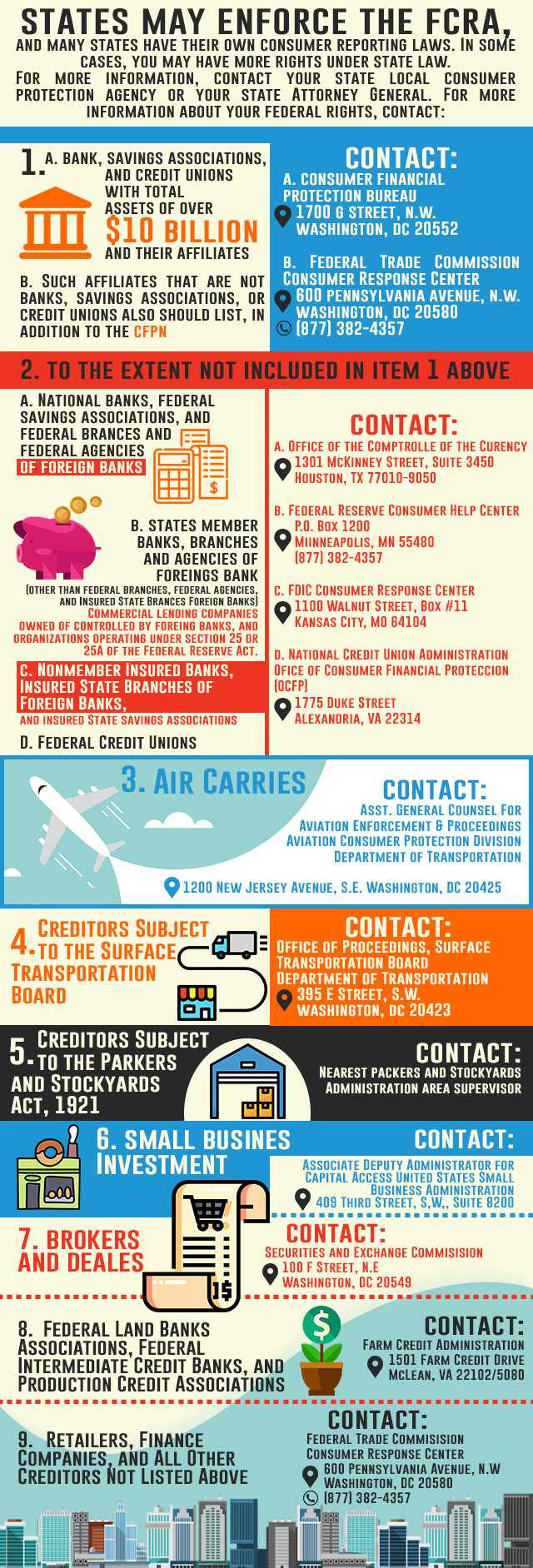

FCRA stands for Fair Credit Reporting Act. It is federal legislation that advocates the accuracy, fairness, and privacy of information used by consumer reporting agencies. Information listed in the consumer reports is used in many aspects of our lives, including:

- Obtaining a loan,

- Background checks for employment,

- Getting the optimal interest rates, or

- Easier time renting an apartment.

A huge part of our lives is affected by the 3-digit score shown on our credit. This makes it extremely important for us that everything that is reported on our credit reports are accurate and are being used fairly.

To encourage credit reporting agencies to maintain the accuracy, fairness, and privacy of consumer information, the agencies are held accountable for any actions that violate the FCRA. For example, any violations that cause statutory damages may cost credit reporting agencies up to $1,000 per violation.

Disputing Errors on Credit Reports

One way consumers can improve their credit score is by disputing errors on credit reports. Credit report errors can arise from:

- Clerical errors with your name, address, or other personal information,

- Mistaking your information as someone else with the same name,

- Prior bad debts that still show up after seven years, or

- Identity theft.

If any of the above applies to your credit report, there are several ways to remedy the problems.

Writing a Credit Dispute Letter to Credit Reporting Agencies

One way to correct or remove errors on your credit report is to send a credit dispute letter to the credit reporting agencies. A credit dispute letter composes of the errors that exist on your credit and your request for the credit agencies to investigate and correct the mistakes listed in your letter.

Look For Any Errors in Your Most Recent Credit Report

To find out if errors are in your credit report, the first step would be to pull the most recent report of your credit. You can pull a free annual copy of your credit report on AnnualCreditReport.com.

After you have the most recent copy of your credit report, look through the data thoroughly to spot any items that are inaccurate. If you do find any inaccuracies, make a list to keep track of them.

Drafting the Dispute Letter to the Credit Bureau

Once your list is complete, the next step is to compose the dispute letter that you will be sending to the agencies. If you need help writing the dispute letter, consult with a credit dispute attorney or check out this link for a template.

After you are satisfied with your letter, it is time to mail it to the credit bureau. Make sure to enclose copies of documents that support your disputes. It is a good idea to identify each error in your report in some way (e.g. circling the error) so the agency will have an easier time locating the items in dispute.

Send your mail by certified mail, return receipt requested, so you can track if the credit reporting agency has received your correspondence. Keep all copies of your dispute letter and the enclosed documents for records purposes.

When the credit bureau receives your letter, they have 30 days (usually) to investigate and take proper actions accordingly to your disputes. If they do not respond to your dispute within the 30 days, it is a violation of the FCRA. At this point, you may take legal actions to get the investigation started.

Benefits of Having a High Credit Score

By fixing any errors on your credit report, your credit score should go up. With a good credit score, you will have a much easier time with your financial life and help you save money. Here are some benefits of having a high credit score.

Lower Interest Rates

Good credit score shows that you have the ability to pay off your debt better than those with lower scores. For this reason, you will qualify for the better interest rates and will pay less in interests. By spending less on interests, you can have more money available for other expenses.

More Bargaining Chips

Having a good credit score will give you the option to negotiate for a lower interest rate on loans. Since companies don’t turn away consumers with high credit scores, you can say that you’ve received generous offers from other companies to persuade them. Of course, this strategy would not work for those with lower credit scores since it’s more of a risk for the lenders.

Other areas to search for FCRA Attorneys include:

- Best FCRA Attorney Long Beach

- Best FCRA Attorney Beverly Hills

- Best FCRA Attorney Glendale

- Best FCRA Attorney Hollywood

- Best FCRA Attorney Orange

- Best FCRA Attorney Manhattan Beach

- Best FCRA Attorney Torrance

- Best FCRA Attorney Riverside

FCRA Attorney Best FCRA Attorney