Calling an experienced San Diego foreclosure lawyer is the best way to save a home from foreclosure in San Diego.

There are many ways to stop foreclosure or slow down a foreclosure, but taking legal action is the best way to save a home from a foreclosure sale. When a lender sends a notice of default or notice of trustee sale, hiring a foreclosure attorney is the home owner’s best protection against losing the home.

When trustees and mortgage lenders move forward with foreclosures, San Diego residents have legal protection under the California laws. When looking for an experienced foreclosure attorney, San Diego residents often call the team at Consumer Action Law Group for quick and effective legal action. San Diego County foreclosures, under the California state laws, are best stopped by filing lawsuits or filing bankruptcy.

How to select the best Foreclosure Attorney San Diego

When selecting a foreclosure attorney, San Diego residents should make sure that their lawyer has stopped foreclosures with both methods; instead of locking a homeowner into one option that doesn’t make sense. To file a lawsuit against the mortgage lender, the attorney looks into the foreclosure procedures to see if there have been any violations of the California laws.

Once a homeowner is represented by a foreclosure attorney, San Diego bankruptcy filing will stop a sale immediately. Upon filing bankruptcy, the court automatically stops all other legal proceedings until such a time when the bankruptcy court determines what is owed and who is entitled to collect debts.

Get the Right Foreclosure Prevention Help

When a homeowner needs immediate help from a foreclosure attorney, San Diego should call to discuss their situation and determine which is the best option: filing a lawsuit, declaring bankruptcy, or looking at other non-legal alternatives such as walking away from the house in a short sale or deed in lieu of foreclosure. San Diego foreclosures can be avoided by hiring a good foreclosure attorney.

A home owner has a chance to fight foreclosure and maintain possession of their house if the mortgage lender is moving forward without giving an option for remaining in the home. To effectively stop foreclosures, San Diego residents are strongly advised to call a lawyer with a track record in saving homes.

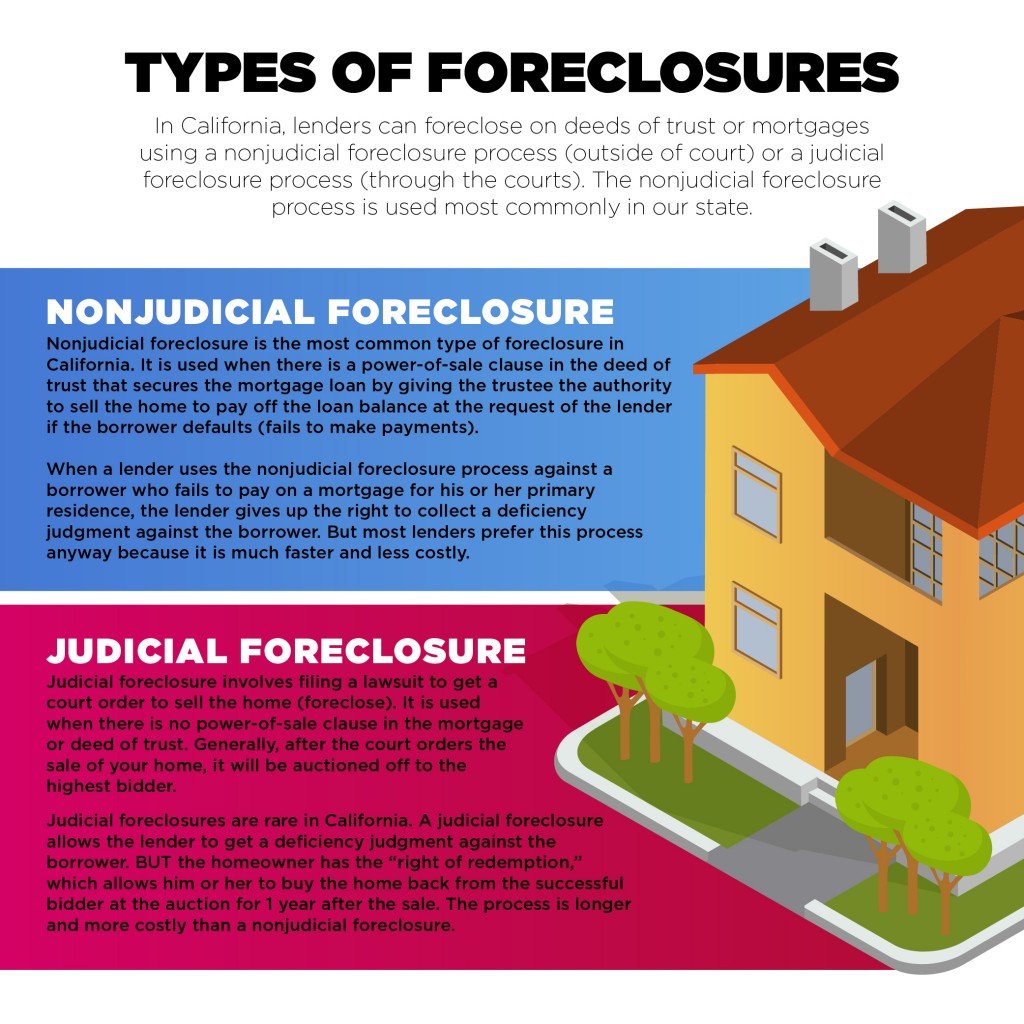

Types of Foreclosures

According to California Courts, there are two types of foreclosure in California that lenders can choose from when foreclosing on deeds of trust or mortgages:

- nonjudicial foreclosure or

- judicial foreclosure.

The nonjudicial foreclosure process occurs outside of court whereas a judicial foreclosure process takes place through the courts. In California, the nonjudicial foreclosure process is most commonly used.

Nonjudicial Foreclosure

The nonjudicial foreclosure is the most common type of foreclosure in California. It is usually used when there is a power-of-sale clause in the deed of trust that secures the mortgage loan. This means that the trustee now has the authority to sell the home to pay off the loan balance at the lender’s request in the case the borrower does not make payments.

Judicial Foreclosure

Judicial foreclosure involves filing a lawsuit to get a court order to sell the home. Contrary to the nonjudicial foreclosure process, judicial foreclosure is used when there is no power-of-sale clause in the mortgage or deed of trust. When the court orders the home to be foreclosed, it will generally be sold to the highest bidder in an auction.

* Information for infographic provided by courts.ca.gov/1048

* Information for infographic provided by courts.ca.gov/1048

Foreclosure Process

The following are the steps for a nonjudicial foreclosure process. The majority of foreclosures in California follow the nonjudicial foreclosure.

- Before the lender begins the foreclosure process on your home, the lender, by law, is required to contact you and anyone else on the mortgage loan to discuss your financial situation and options to save your home from foreclosure.

In this step, the lender:- Can only start the foreclosure process after 30 days from discussing ways to save your home from foreclosure. It is illegal to begin the foreclosure process while in discussion to save your home and

- Must inform you during that first meeting the right you have to request a second meeting to discuss options to avoid foreclosure. The requested meeting must take place within 14 days of the first meeting.

- You can also authorize a lawyer, an HUD-certified housing counseling agency, or other advisor to talk on your behalf with the lender to discuss ways for avoiding foreclosure. However, you are not required to accept any proposal that they come up with.

- If no options were finalized during the meeting with the lender, the lender can record a Notice of Default in the county your home is located in once 30 days have passed from that meeting. The foreclosure process on your home is then officially begun.

You will receive a notice of the public foreclosure by certified mail within 10 business days of recording it. You then have 90 days from the day the Notice of Default is recorded to relieve the default, usually by paying it off. - If you still have not paid off the mortgage, a Notice of Sale will be recorded after at least 90 days have passed from when the Notice of Default was recorded. In 21 days, the trustee will be able to sell your home through an auction.

The Notice of Sale must:- Be sent to you by certified mail.

- Be published weekly in a newspaper in the county where your home is located for 3 consecutive weeks before the sale date.

- Be posted on your property and in a public place.

- Contain the time, location, and date of the foreclosure sale, the trustee’s name, address, and phone number, and a statement that the property will be sold at a public auction.

- A public auction for your home can start once 21 days have passed since the Notice of Sale is recorded. The winning bidder will immediately pay the full amount of the bid with

* Information provided by courts.ca.gov